Manulife One Discovery Centre

Welcome to Manulife One

Generally, a traditional mortgage works like this—you take out a large loan, you make fixed payments on the loan, including a lot of interest. And at some point, in the distant future, you’re mortgage-free.

To become debt-free sooner, you know you could make extra mortgage payments along the way—but you don’t because you want to keep that money available for other things, like an emergency. So you keep some of your money in a rainy-day savings account, earning less interest than you’re paying on your mortgage. And you keep more money in a chequing account, earning no interest at all. Sound familiar?

Better way to bank

What if you could use all your money to pay down your mortgage, and still have easy access to it? What if you could save a lot of interest and become debt-free much sooner? What if there was a better way to bank? Welcome to Manulife One.

Manulife One is an all-in-one banking solution that combines your mortgage, savings, chequing and income into one easy-to-use account. Having one solution for all your everyday banking can simplify your life and help you keep more of your hard-earned money. You could:

- Be debt-free sooner

- Say good-bye to inflexible mortgage payments

- Pay less interest on your debt

- Be prepared for whatever life throws your way

- Customize your mortgage to fit your life

- Create a retirement backup plan

Manulife One is a better way to manage your finances – making your money work harder, so you don’t have to.

Because Manulife One offers so much more than a traditional mortgage, we’ve created this guide to help you understand how it works. After reviewing this module to understand the basics, you can pick and choose the topics in the Discovery Centre that interest you most and find out how Manulife One can work for you.

Manulife One’s Main Account –

it’s a combined line of credit and bank account

The Manulife One Main Account is similar to a line of credit in that it allows you to easily access the equity in your home. And as you pay down the debt in your Main Account, you can reborrow that money, up to your borrowing limit. For example, if you use your emergency savings to reduce your Main Account balance by $10,000 (saving you interest!), you can easily reborrow that $10,000 later, if a need arises.

This is a big difference from a traditional mortgage where, once you make an extra payment, you can’t easily get that money back.

But unlike a traditional line of credit, the Main Account is also a bank account with all the features you’d expect.

Manulife One works best when you use the Main Account for all your everyday banking. To make sure you’re taking full advantage of your Manulife One, you’ll want to have your income automatically deposited into the Main Account and use it for your regular spending, like buying groceries and paying bills. That way, when you get paid, the full amount of your income immediately lowers your debt and saves you interest.

Better yet, the money you have left over at the end of each day stays in your account, reducing your debt. Over time, keeping your extra money in your Main Account could help you become debt-free years sooner and save you a lot of interest along the way.

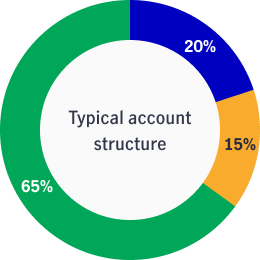

Manulife One: how the account is typically set up

With a Manulife One mortgage, you can borrow up to 80% of the appraised value of your home. A Manulife One mortgage is generally made up of two portions:

- the Main Account (combined bank account and line of credit you can use for everyday banking), and

- a term sub-account (debt that’s locked in for a fixed term, with regular payments – like a traditional mortgage).

Any debt up to 65% of the value of your home can go into the Main Account. If you borrow more than 65% of the value of your home, the portion above 65% is locked into a term sub-account.

Once your account is set up, you can use our mobile app or online banking to see the amount you’ve borrowed in your Main Account and your term sub-account.

Unlimited Daily Banking fee

We get it, no one likes fees. But remember, Manulife One isn’t just a mortgage or line of credit, it’s also a full-featured bank account. The monthly fee of $16.95 ($9.95 if you’re 60 or older) includes the following unlimited daily banking transactions:

- Online and mobile banking—available 24/7—and telephone banking

- Sending and receiving money using Interac® e-Transfer

- Direct deposits of Canadian funds, like your pay or other income

- Bill payments and pre-authorized payments

- Fund transfers to or from another Canadian financial institution

- Debit card purchases in Canada

- Deposits and withdrawals at thousands of ATMs across Canada1

- Cheque writing in Canadian funds

Don’t want to pay the Unlimited Daily Banking fee? Here’s how to avoid it.

You can get the ManulifeMONEY+™ Visa Infinite* card to avoid paying the monthly fee.2 We'll waive the Unlimited Daily Banking fee for the first year you’re an active cardholder. After that, we'll waive the fee when you spend $20,000 a year on your card3.

Let’s review

- With Manulife One, you can borrow up to 80% of the appraised value of your home. If you borrow the full 80%:

- Up to 65% will be in the Main Account

- At least 15% will be in a term sub-account.

- The Main Account is both a line of credit and a bank account.

- Interest is calculated daily on the Main Account so the less debt you have at the end of each day, the less interest you’ll pay.

- Manulife One is part of your overall financial plan where you can:

Next steps

We invite you to talk to your advisor as part of your overall financial plan or your mortgage broker to find out more about Manulife One. If you don’t work with an advisor or broker, our Find an advisor tool can help you find one.

Discover more

Interac® is a registered trade-mark of Interac Corp. Used under license.

*Trademark of Visa Int., used under license.

1Other convenience fees may apply to withdrawals made at ATMs that are not part of THE EXCHANGE® Network and direct-payment purchases using your Manulife Bank debit card.

2 Subject to credit approval.

3We will waive your Manulife One Unlimited Daily Banking fee only for your first 12 consecutive months (1 year) so long as your credit card account is open and in good standing. The Manulife One Unlimited Daily Banking fee ($16.95 Regular and $9.95 Senior) is disclosed at https://www.manulifebank.ca/personal-banking/mortgages/manulife-one.html#fees. You will still be responsible for any other type of fee that may apply to your Manulife One account during the waiver period. Fees are subject to change at any time with 30 days prior written notice. Your Manulife One Unlimited Daily Banking fee will continue to be waived in each year if you spent a minimum of $20,000 in net purchases on your card in the prior year. For example, if you spent a minimum of $20,000 in net purchases on your card during the first year, your Manulife One Unlimited Daily Banking fee will be waived in each month of the second year during which your account is open and in good standing. If you spent less than $20,000 in net purchases on your card during the first year, you will not be entitled to the Manulife One Unlimited Daily Banking fee account fee waiver in any month of the second year. If you then spent a minimum of $20,000 in net purchases on your card during the second year, you will be entitled to the Manulife One Unlimited Daily Banking fee waiver in each month of the third year during which your account is open and in good standing. Annual spending is based on the anniversary of the date you opened your credit card account and ends 12 months later. Year-to-date annual spending will appear on your monthly credit card statement. The Unlimited Daily Banking fee will reappear on your next Manulife One statement after the initial 12-month waiver period has elapsed or in any subsequent year if the total amount of net purchases on your card in the prior year is less than $20,000. Applies only to a personal Manulife One account for which the primary cardholder is the sole or joint Manulife One account holder. Offer is only available to first time ManulifeMONEY™+ Visa Infinite Primary Cardholders and applies only to one Manulife One account per primary cardholder. Offer may be changed or withdrawn at any time without prior notice.

Manulife One is offered by Manulife Bank of Canada.

Manulife, Manulife Bank & Stylized M Design, ManulifeMONEY+, Stylized M Design and Manulife One are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.