On this page

Instruction: Change of selection promptly shifts the focus to a matching heading further down, on the same page.

Use your Manulife One account

With Manulife One, you get much more than a mortgage. You get the flexibility to respond to life’s opportunities and challenges as you work towards your financial goals. Not only that, you could save thousands in interest and become debt free sooner. Here’s how:

- Deposit your pay: have your pay directly deposited into your account to reduce your debt – and your interest costs – on a regular basis. Give your employer your direct deposit form, which you can download and print from online banking after you sign in.

- Choose your account from the home page

- Select Direct deposit form (PDF) under More.

- Put your money to work: holding cash in other chequing or savings accounts? Moving that money into your Manulife One account not only reduces your debt and interest costs, but also eliminates any fees from the other accounts.

- Repay other loans: if you have enough borrowing room, use your Manulife One account to pay off any higher-interest loans. This will help reduce your overall interest costs.

- Simplify your banking: make bill payments and track your expenses within your account.

Learn more about your account in the Manulife One Client Guide (PDF).

When you buy a home, mortgage-freedom can often seem like a distant destination. But, what if you could get there faster and save thousands in interest along the way? Here’s how Manulife One can help you reach mortgage-freedom sooner.

Bank your way

Manage your Manulife One account using our mobile app, online banking, or by calling us at 1-877-765-2265. And of course, you can use your bank card at thousands of ATMs across Canada and to make Interac® Debit purchases.

Daily withdrawal/transaction limits

Here are the default daily limits for different transaction types:

- ATM withdrawals: $1,500/day

- Point of sale/debit transactions, including in-store cash back: $3,000/day

- Outgoing transfers: $50,000

- Interac e-Transfer®: $3,000/transfer, $3,000/day, $10,000/week, and $20,000/month

These apply to most people, however, there are situations where individual limits may be different. Our limits are in place for your protection and to comply with regulations. If you have questions about your transaction limits or need to exceed that limit, give us a call.

For many of us, becoming debt-free is the ultimate goal. And for most Manulife One customers, even after their debt is paid off, they keep their account. Here are three reasons why Manulife One is an account for life.

Fees

$16.95 Unlimited Daily Banking* fee ($9.95 if you’re 60 or older). We’ll waive the fee when you pay your line of credit in full (including your sub-accounts) and have a positive balance of at least $5,000 in your main account at the end of the month.

*Learn more about Manulife One fees.

Statements

Each month, you’ll receive a comprehensive statement for your Manulife One account, showing you how you are progressing toward paying off your debt. You can choose between electronic or paper statements. By default, we'll send you paper statements by mail. You can change the type of statement using online banking or by calling us at 1-877-765-2265.

You can also review statements using online banking or our mobile app.

Sub-accounts

When you applied for your Manulife One, you had the option to separate your debt into sub-accounts. There are two types of sub-accounts: term sub-accounts and tracking sub-accounts.

Term sub-accounts

A term sub-account acts like a traditional mortgage, allowing you to lock in some of your debt with a defined amortization period and predictable monthly payments. You can have up to five term sub-accounts with a fixed or variable rate and an open or closed term.

Using a term sub-account to lock in part of your debt can be a great option if:

- You’re concerned about variable interest rates going up

- You want to take advantage of fixed rates being lower than the Manulife One base rate, or

- You want to make sure a portion of your debt is repaid over time.

How do term sub-accounts work?

Let’s look at how term sub-accounts can help you take advantage of the best rates available and ensure your debt is being repaid over time.

When you must have a term sub-account

If your Manulife One credit limit is between 65 and 80% of the value of your home, any borrowed amount over 65% must be allocated to a term sub-account.1 (Tip: refer to the example below.)

For small business owners and people who use Manulife One to buy an investment property, any amount borrowed over 50% of the value of the property must be allocated to a term sub-account.

In both cases, each monthly principal payment or lump-sum payment you make to your sub-account will decrease the credit limit of your main account.

When you can choose to have a term sub-account:

If your Manulife One limit is below 65 per cent of the value of your home and you choose to set up a term sub-account, you can make payments that either:

- Decrease the credit limit of your main account; or

- Create additional borrowing room in your main account.

Tracking sub-accounts

A tracking sub-account allows you to track part of your debt and the interest it’s charged separately, at the same low variable interest rate as your main account. This is useful if, for example, you’ve purchased an investment and want to track the debt separately for tax purposes.

Tracking sub-accounts give you the flexibility to choose monthly interest-only payments or principal and interest payments.

How do tracking sub-accounts work?

Let’s look at how you can track some of your debt and the interest it’s charged separately, such as money borrowed for a car or an investment.

To set up a term or tracking sub-account, sign into online banking or call us at 1-877-765-2265.

How term and tracking sub-accounts can work for you

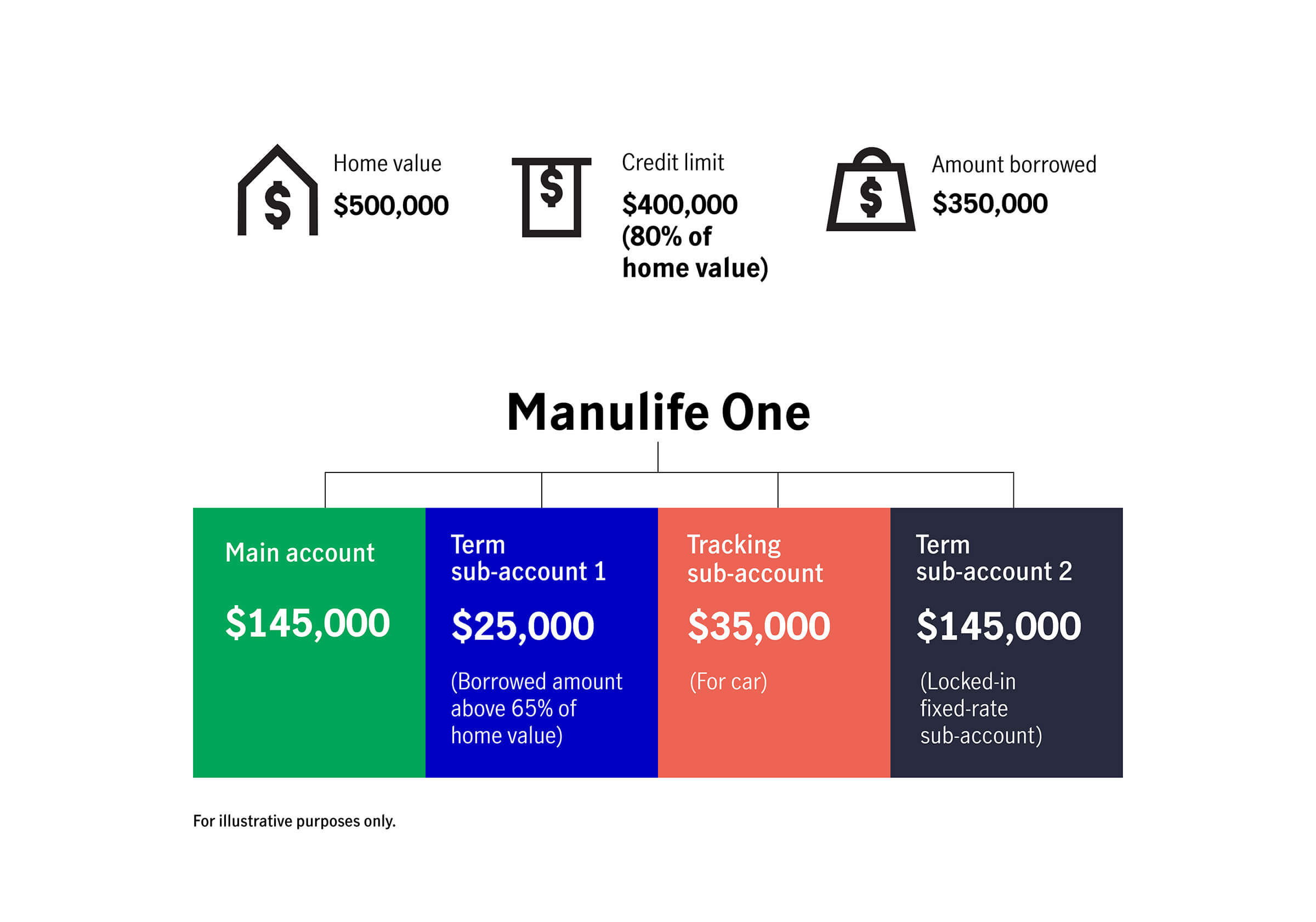

For this example, let’s say the value of your home is $500,000 and you opened a Manulife One with a credit limit of $400,000 – 80% of the value of your home. Let’s also say you’ve borrowed $350,000.

Your first term sub-account

Since you borrowed $350,000, you must allocate $25,000 – the amount above 65% of the value of your home – to a term sub-account.

Here’s the math:

$500,000 (home value) x 65% = $325,000

$350,000 (total borrowed) - $325,000 (65% of home value) = $25,000 to term sub-account

As you pay down this term sub-account, your payments will reduce the credit limit of your main account by the amount of each principal payment you make.

Using a tracking sub-account

In this example, your amount borrowed of $350,000 includes a car purchase of $35,000. Because you want to track the interest and payments on your car, you set up a tracking sub-account with a balance of $35,000. As you pay down your tracking sub-account, the amount of each principal payment you make becomes available as credit in your main account.

Adding a second term sub-account

After factoring in both sub-accounts, the remaining balance in your main account is $240,000.

Here’s the math

$350,000 (total borrowed) - $25,000 (term sub-account #1) - $35,000 (tracking sub-account) = $290,000 (main account balance)

You decide to lock half of this balance – $145,000 – into a fixed-rate sub-account to help reduce worries about rising interest rates. You can set up this term sub-account so the amount of each principal payment you make becomes available as credit in your main account.

After setting up the second term sub-account the balance of your main account is $145,000.

Here’s an example showing how you could use term and tracking sub-accounts to achieve your goals:

Enhance your account

With Manulife One, you have access to complementary products that can help provide extra protection and flexibility, including:

- Mortgage protection insurance: an inexpensive way of protecting your financial stability and maintaining your family’s standard of living should an unexpected death, disability or job loss occur.2

FAQ

If your home appreciates in value, you may be able to increase your credit limit. A credit limit increase may be subject to credit approval and you may need to put part of your debt in a term sub-account. Fees apply. You can request an increase to your credit limit through our mobile banking app, online banking or by calling us at 1-877-765-2265.